Loqbox

Improving retention through smarter cancellation flows

My role

Responsible for discovery, workshop facilitation, concept design, usability testing and experiment design.

Team

Product designer (me), Product manager, Lead engineer,

3 engineers, QA

Duration

12 weeks

Outcomes achieved

- 11.6% reduction in customer cancellations

- Improved payment success and reduced avoidable churn

- Rolled out as the default experience

Context

Customers were cancelling their Loqbox membership when they really just needed a way to reduce their monthly cost. I redesigned the cancellation journey to introduce a clear option to remove paid add ons without cancelling completely, which reduced unnecessary churn and helped more people stay with the product in a way that felt sustainable.

PROBLEM

Affordability as a barrier

Customers who were struggling with affordability often chose to cancel their Loqbox membership entirely.

- Customers wanted to lower what they were paying.

- The cancellation flow did not give them the option to do that.

This led to avoidable churn and reduced the long term impact Loqbox could have for those customers.Goal: Understand why customers were cancelling and find a way to reduce churn.

DISCOVERY

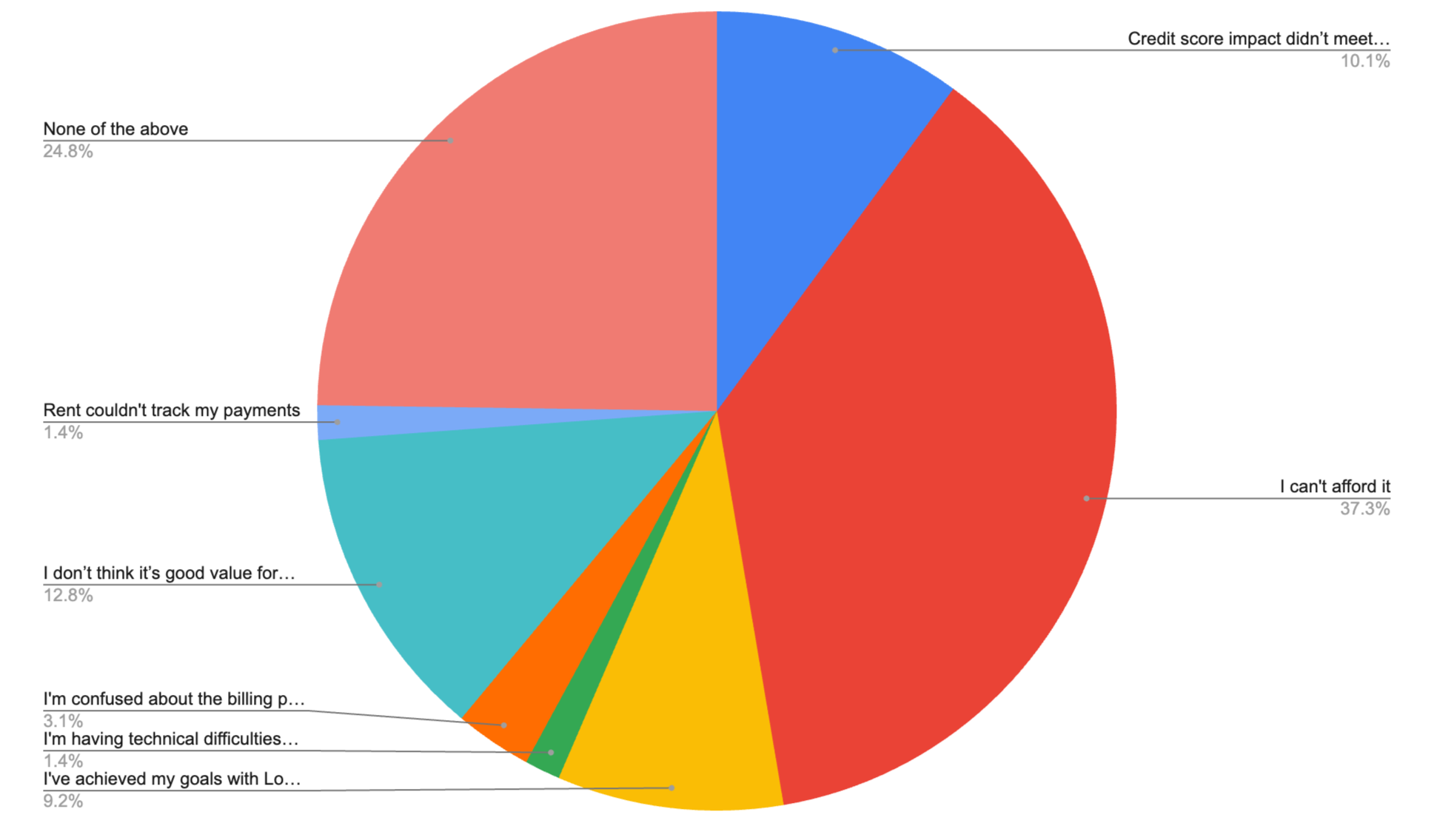

Analysed behaviour cancellation reasons

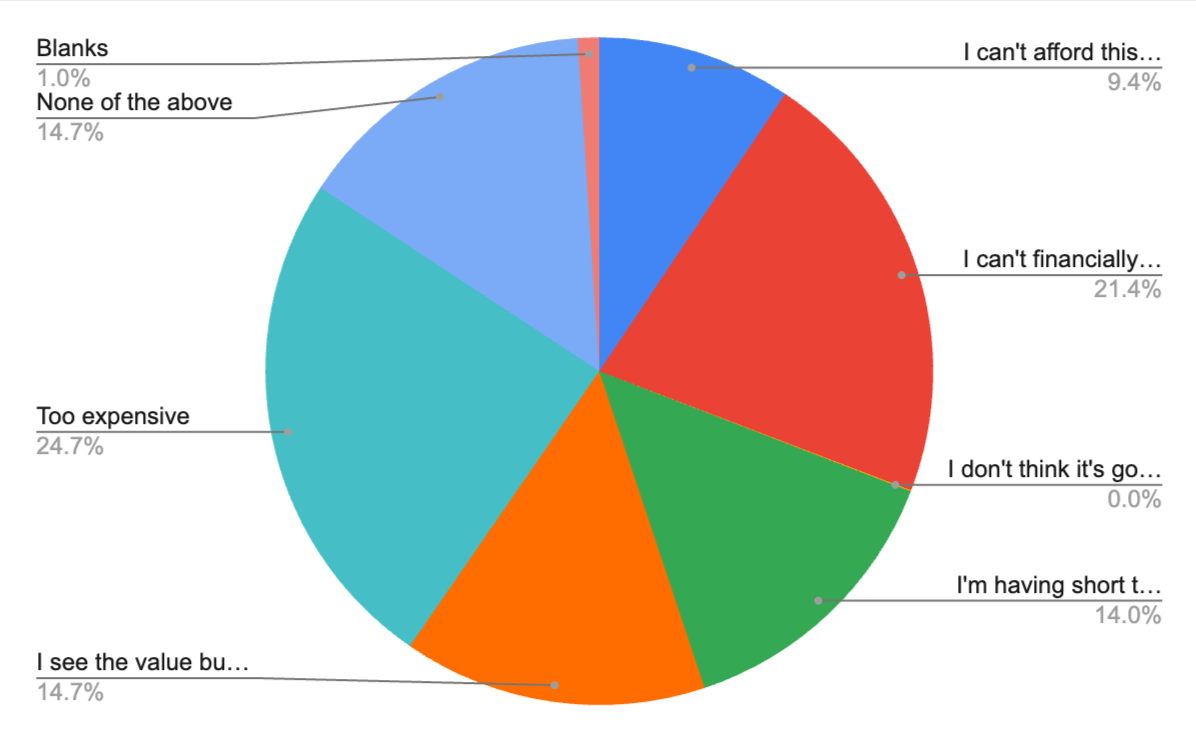

I worked with engineering to gather data to review exit survey responsesWe saw that customers were leaving because of affordability concerns.Looking at the sub reasons gave more detail behind the affordability concerns:

- “It’s too expensive.”

- “I can’t financially commit long term.”

- “I’m having short-term financial issues.”

Main cancellation reasons

Sub cancellation reasons

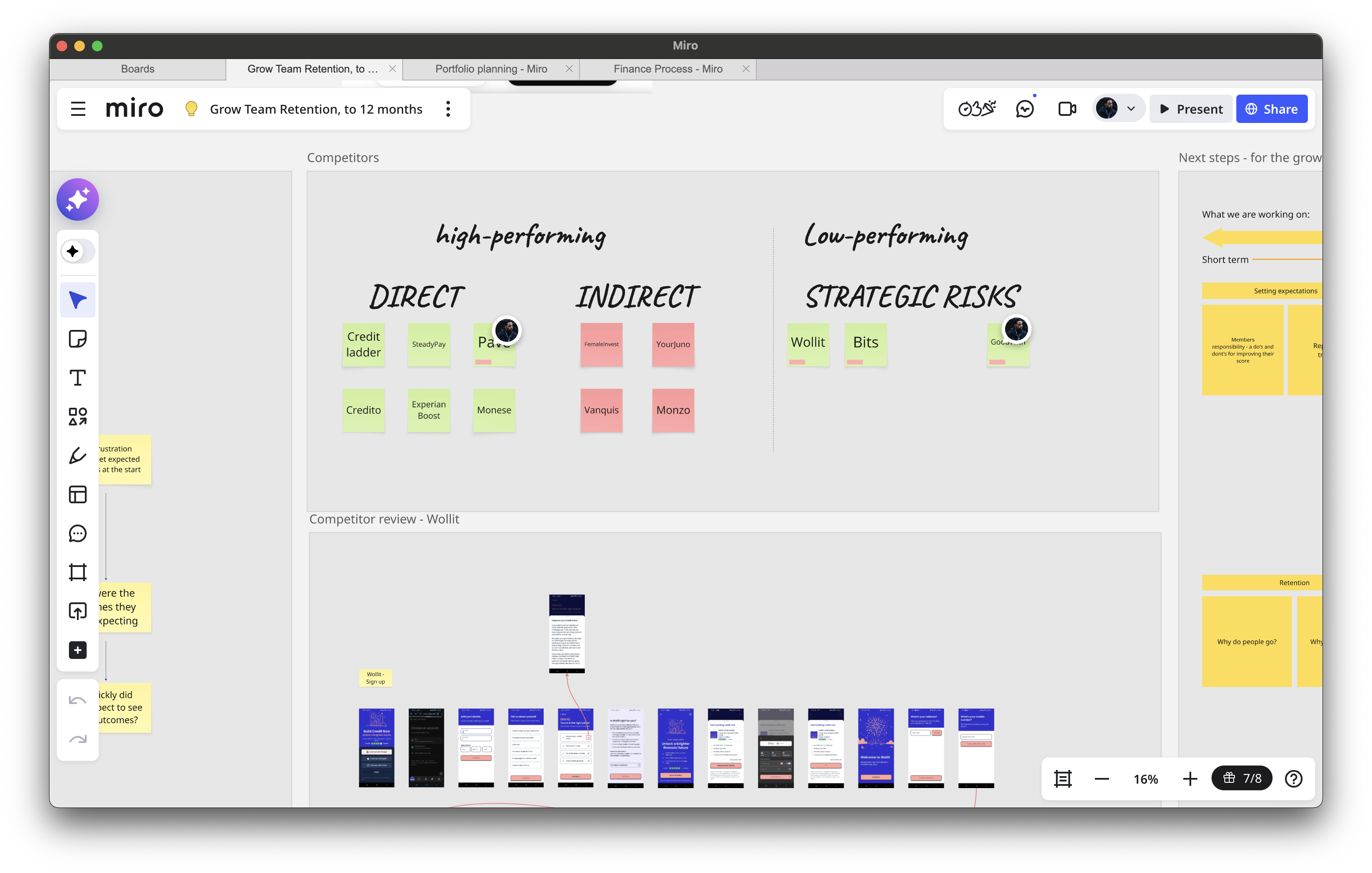

How our competitors handle cancellation

I reviewed competitor experiences, customer cancellations and retention strategies. What I found was:

- Provided clear context about the customer’s progress in their credit-building journey.

- Set expectations by clearly outlining what actions customers could take to continue improving their credit.

- Tailored retention messaging to match the customer’s specific cancellation reason.

This made it clear that the flow was too binary and did not reflect real customer needs at the point of cancellation.

Miro board of competitor research

EXPLORATION

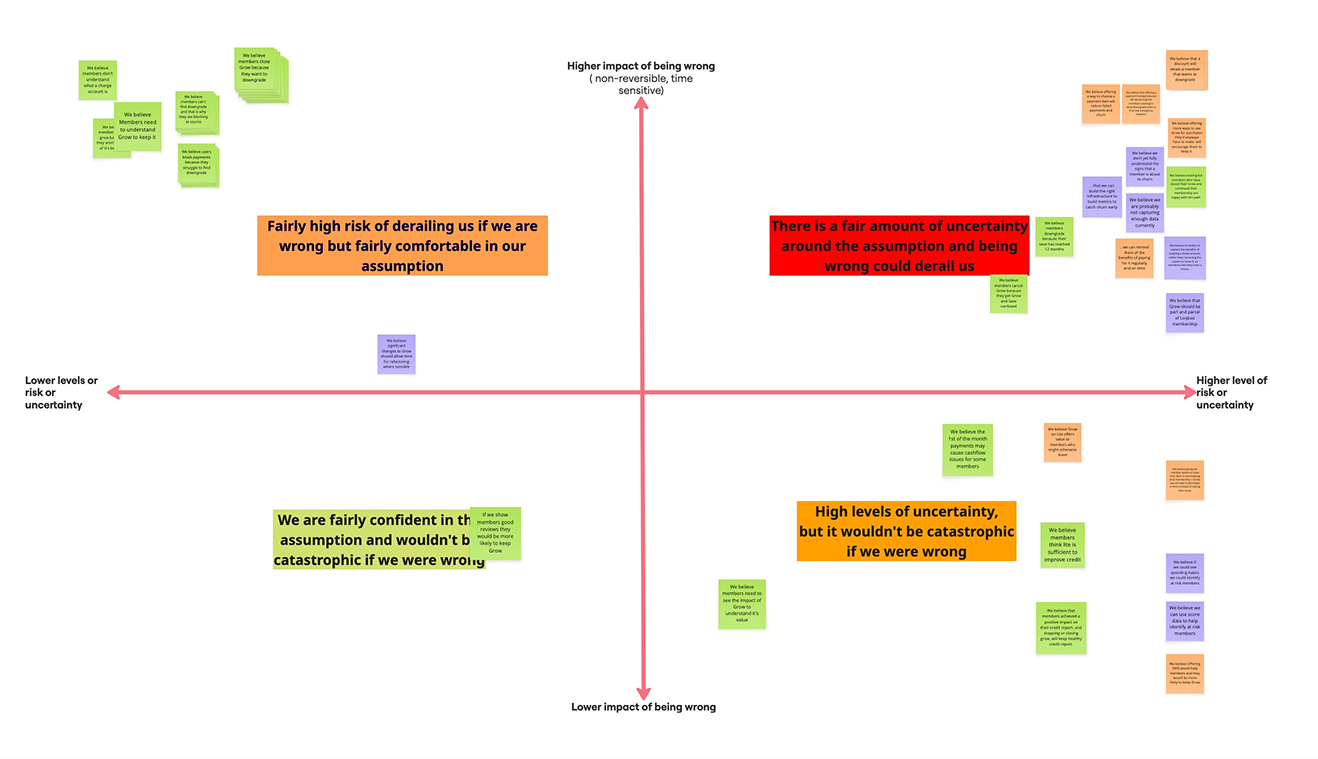

Assumption mapping solutions

I facilitated an assumpt mappi

How might we help customers stay, even when they can’t afford their current plan?”

We explored three ideas:

- Offer a 1 month payment holiday

- Offer a discount in-line with our corporate partner discount

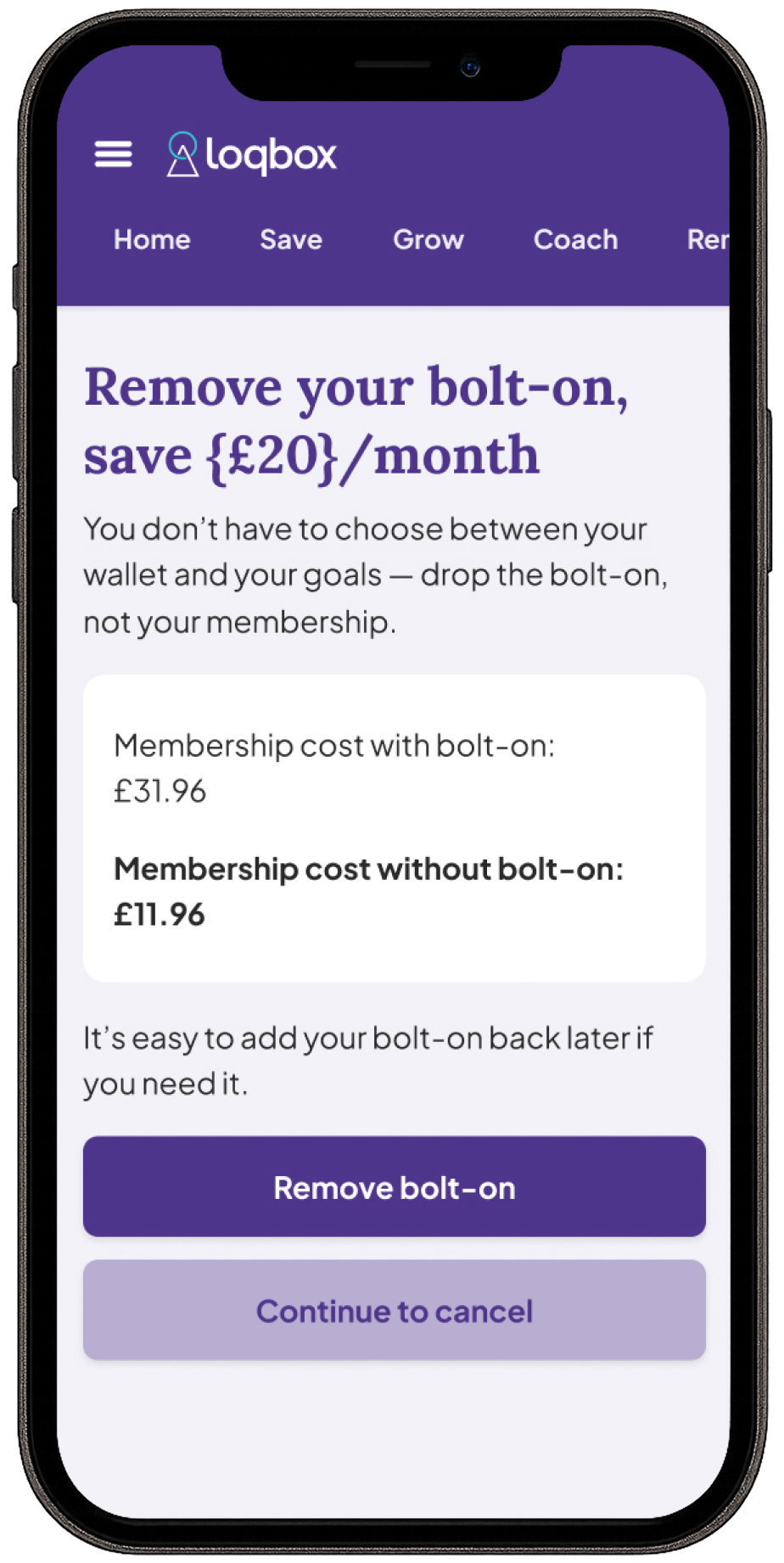

- Let users remove paid bolt-ons and keep the core membership

Note: A bolt-on is an optional add-on that gives customers additional account features such as higher savings limits or access to Loqbox’s financial wellbeing app, for an extra cost on top of their membership fee.

Assumption mapping workshop

Prioritisation and constraintsAfter discussing the options with business and stakeholders there were either technical constraints or commercial constraints that meant we agreed to proceed with idea 3:

- Idea 3: Let users remove paid bolt-ons and keep the core membership

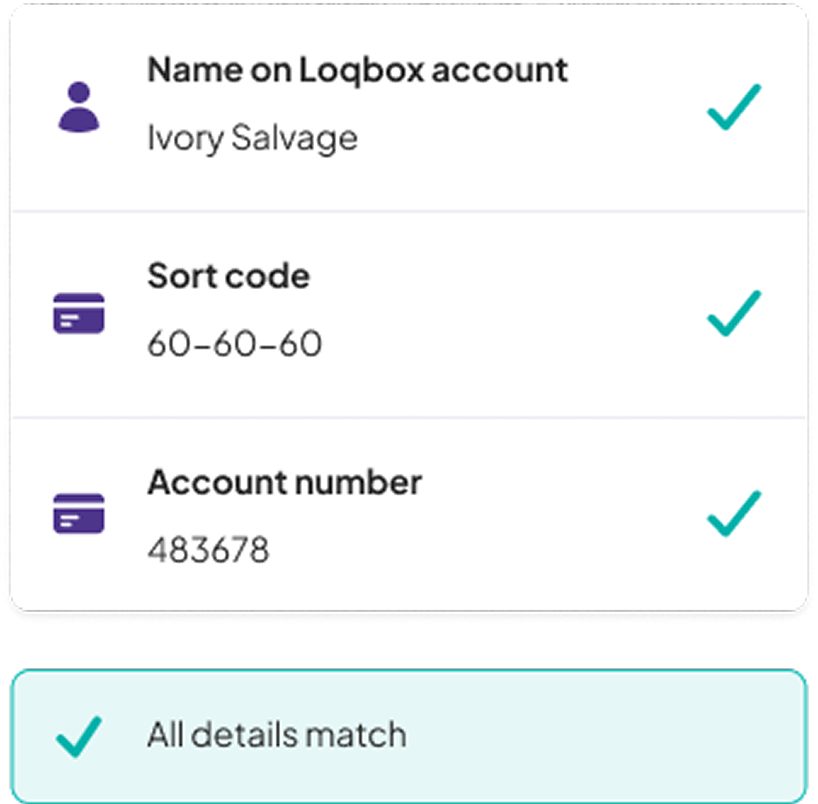

How many members remove their bolt-ons and keep their membership?Our assumption was that customers did not realise they could remove a bolt-on to lower their monthly membership fee. We learnt that only a very small percentage of customers removed their bolt-on and kept their membership.

Defined hypotheses and experiment goals

Working with Product, we defined a hypothesis:

IF customers are given the option to cancel their Bolt-on instead of their full membership THEN overall customers retention will improve BECAUSE we are giving them the option to reduce their bill

We agreed success would be measured by a reduction in cancellations.

Ran an experiment A/B before rolling out

We ran a A/B tested for two months with a sample of 1,229 users (variant + control). The variant won reducing the cancellation rate. We confirmed our hypothesis.

SOLUTION

A clearer, more supportive journey

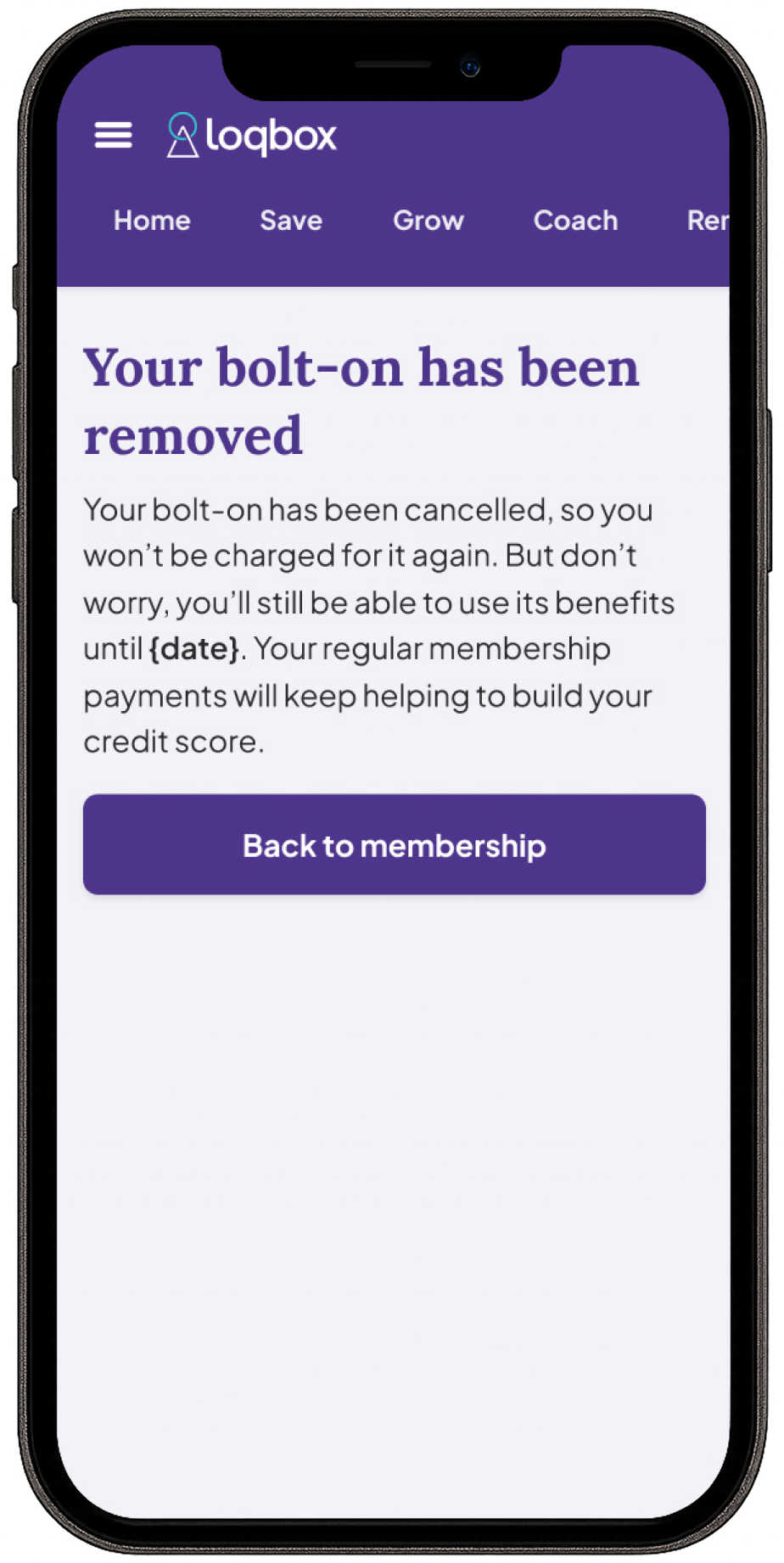

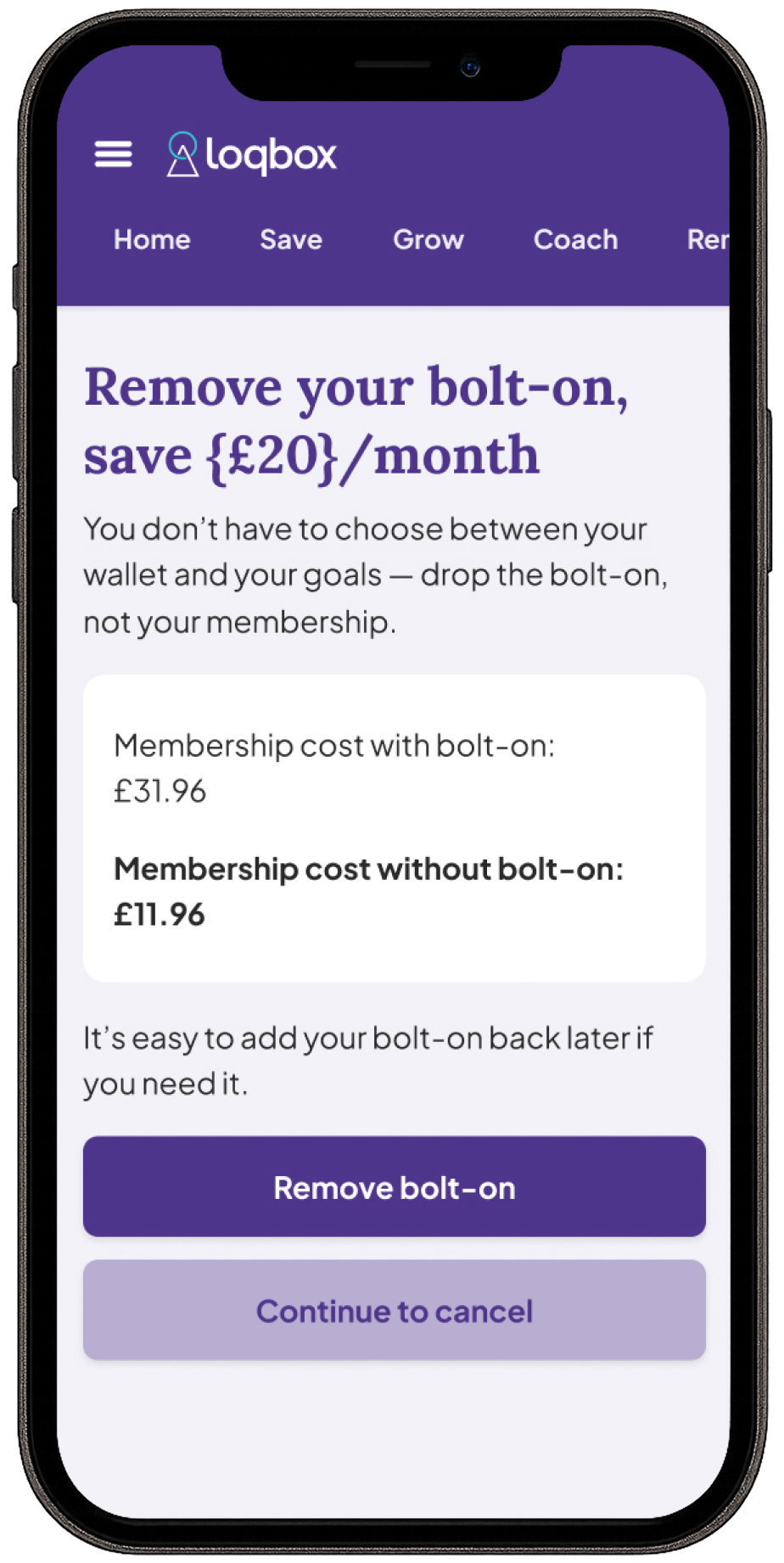

The updated cancellation journey:

- Gave customers a clear alternative to cancellation.

- Made removing paid add ons a visible and easy choice.

- Presented information in plain language, explaining what stays and what changes.

- Restored a sense of control for members under financial pressure.

New screen in the cancellation experience that gave customer the option to remove bolt-ons

Outcomes achieved

- 11.6% reduction in customer cancellations

- Improved payment success and reduced avoidable churn

- Rolled out as the default experience

Reflections and learnings

Giving people a clearer way to stay, on their terms, can be more powerful than trying to convince them not to leave.This project reinforced the importance of designing cancellation flows that respect people’s financial reality while still supporting business goals.