Loqbox

Streamlining the payouts process for reliability and efficiency

My role

Responsible for discovery, process mapping, identifying opportunities and designing improvements.

Team

Product designer (me), Product manager, Lead engineer, 3 engineers

Duration

8 weeks

Outcomes achieved

- Reduced payout related issues by 40%

- Improved the payout experience for 1300+ plus customers each year

- Saved Finance and Customer Support around 6 hours per week

Context

The Loqbox payout process is how members withdraw money from their Loqbox account once they finish their saving journey or request a release of funds. I redesigned Loqbox’s payouts process, which was heavily manual and error prone, to create a more reliable experience for both customers and internal teams. By mapping the end to end journey and integrating Confirmation of Payee through our payments provider, we reduced payout errors and freed up time for Finance and Support teams.

PROBLEM

A process that is prone to errors

The payouts process was generating a steady stream of issues every week.

- There were issues paying customer out each week.

- Customer weren’t recieving their payouts.

- Finance and Customer Support were spending around 2 hours a day dealing with payout related problems.

The process was time consuming for internal teams and frustrating for members when payouts failed.Goal: Understand and identify opportunities to improve the end-to-end payouts process making it more efficient.

DISCOVERY

Understanding the payout process

I worked with Finance, Customer Support and Engineering to map:

- How payouts were requested by members.

- How were payouts processed.

- Why there were issues with paying customer.

This gave everyone a shared view of the full end-to-end process and a view of the process and issues.

Interviews with the customer support and finance

Process mapping of customer support finance and customer payout request

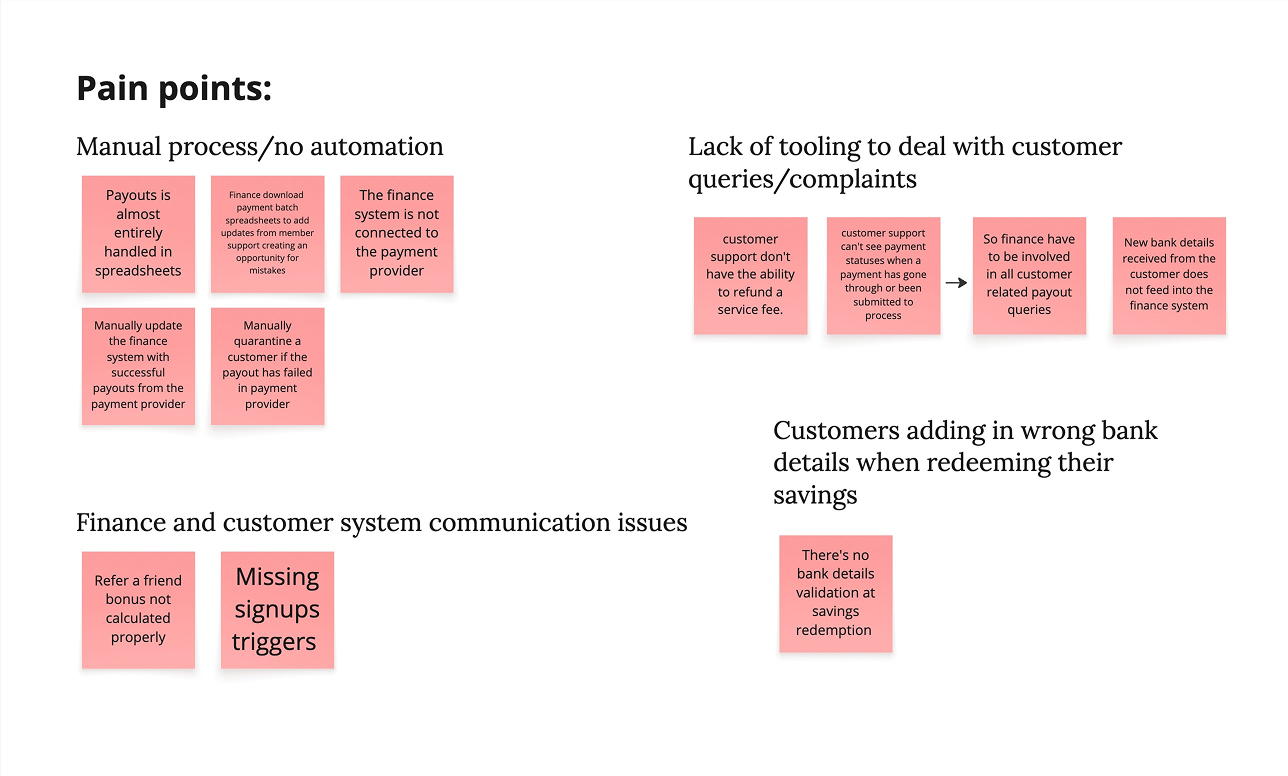

Insights from discovery

Heavy reliance on spreadsheets increased risk

Process mapping sessions with Finance and Support showed that large parts of the workflow depended on manual spreadsheet updates. This made it easy for data to be miskeyed or missed entirely.

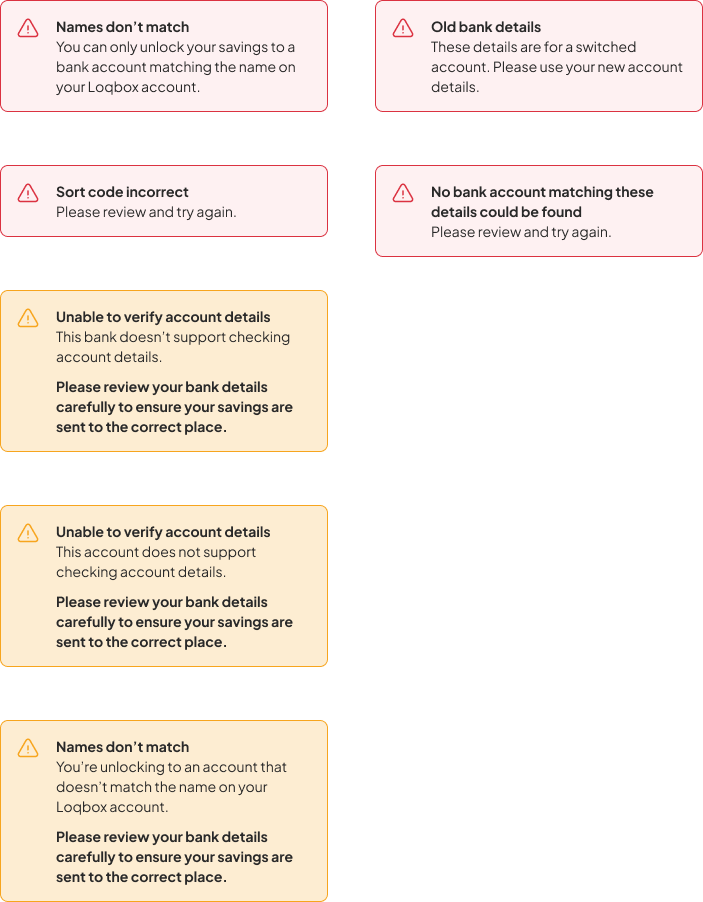

Incorrect bank details were a major source of failure

Process mapping sessions with Finance and Support showed that large parts of the workflow depended on manual spreadsheet updates. This made it easy for data to be miskeyed or missed entirely.

Internal teams were handling issues every day

Payout problems were not rare edge cases. They were a regular part of Finance and Support’s daily work, taking up hours each week.

Pain point themes found during mapping and interviews

Identifying the highest impact opportunities

From the mapped journey, we focused on:

- Reducing reliance on spreadsheets where possible

- Addressing incorrect bank details at the point of entry

We believed that solving these problems would solve a lot of the inefficency problems.

Designing improvements with low implementation effort

I worked with Product, Engineering, Finance and Customer support to discuss the opportunities. We agreed adding validation at the point a customer requests a payout would:

- Stop errors before they happen.

- Remove the need for payout error handling spreadsheets between Finance and Customer support.

SOLUTION

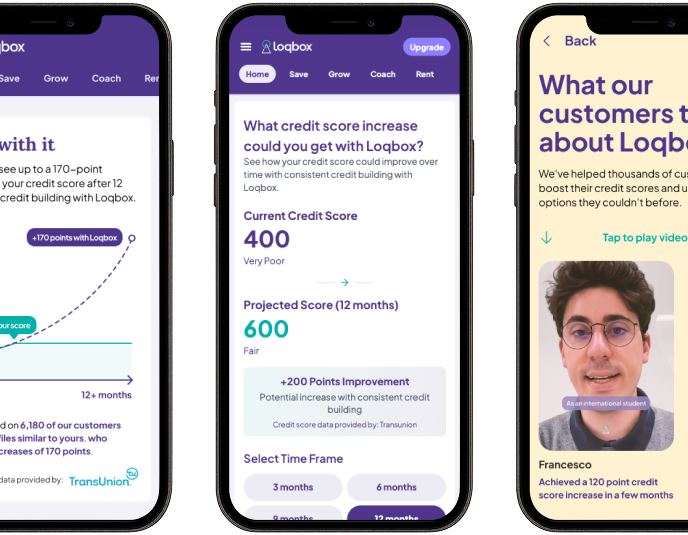

Confirmation of payee

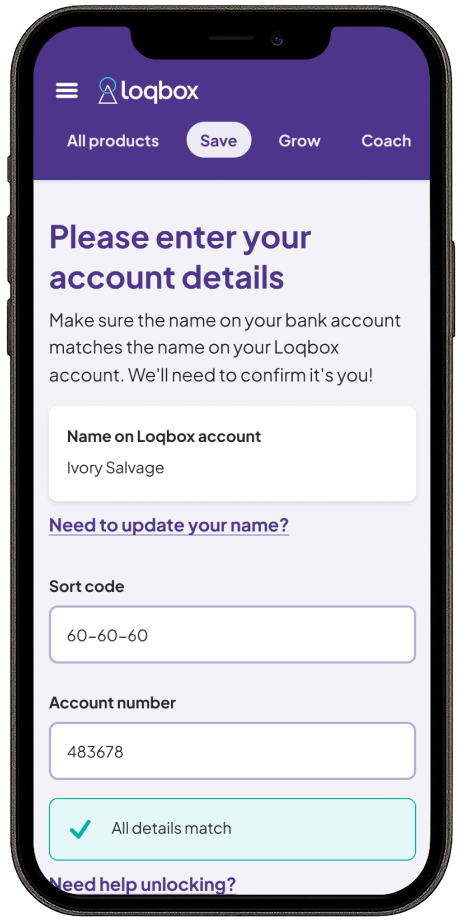

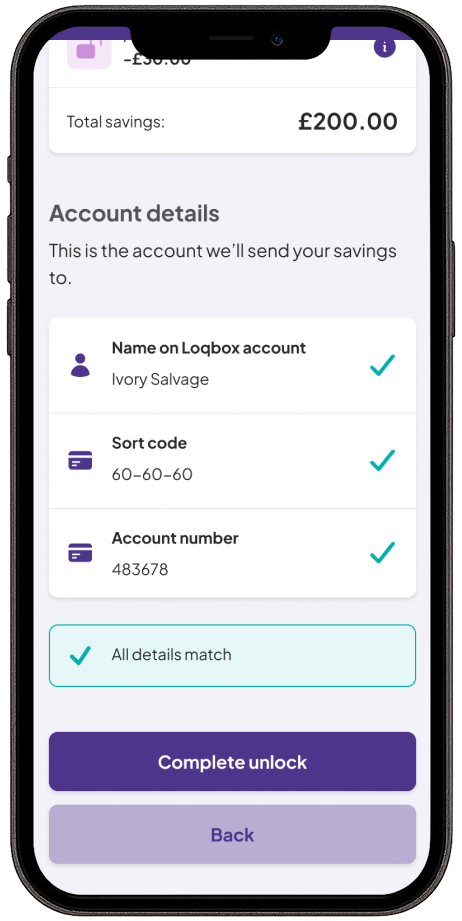

Confirmation of Payee is a bank validation step that checks whether the name, sort code and account number a customer enters matches the correct account holder. If they don’t match, the user is warned. It prevents mistakes at the point of entry and reduces failed payout requests.

Why confirmation of payee works well:

- It reduced payment related issues.

- Removed the need to manage payout spreadsheets tracking payout failures.

- Removed the need for finance to process failed payouts.

Introducing confirmation of payee streamlined the process of managing payouts as well improving the process of requesting. The result was a process that felt simpler to use and easier to support.

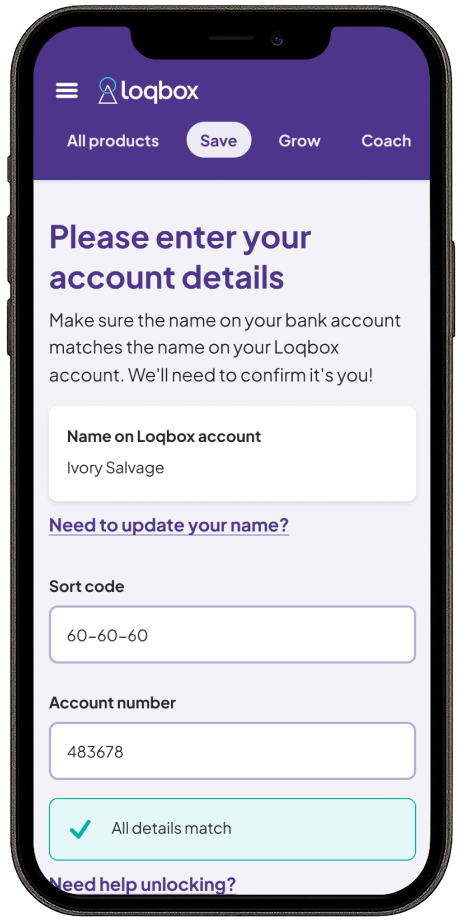

Confirmation of payee at the point customer request their savings payout

Outcomes achieved

- Reduced payout related issues by 40%

- Improved the payout experience for 1300+ plus customers each year

- Saved Finance and Customer Support around 6 hours per week

Reflections and learnings

This project reinforced how important it is to understand the real operational workflow behind a feature, not just the customer facing UI. Small, targeted improvements like removing manual steps and adding validation at the right point can meaningfully reduce errors and free up time for teams.