Loqbox

Building customer confidence with personalised credit experiences

My role

Discovery, insight synthesis, concept development, usability testing

Team

Sole designer working with a Lead Engineer for data support

Duration

3 weeks

Context

Loqbox works best over time, but a significant number of members were cancelling within their first three months. I led work to understand why people were leaving early and how we could help them feel more confident that Loqbox could work for them. This resulted in two concepts focused on clearer expectations and more relatable proof of progress.

Outcomes achieved:

- Clarified the root causes of early cancellations and highlighted confidence as a key driver.

- Identified effective ways to set clearer expectations earlier in the journey.

- Produced validated concept directions ready for further testing and potential A/B experimentation.

- Informed future retention strategy and how Loqbox supports customers through the early months of their credit building.

PROBLEM

Customers are cancelling because their score wasn’t improving

Data showed that many customers cancelled because their credit score hadn’t improved in the way they expected. This was the most common cancellation reason after affordability.

Goal:Understand where these expectations came from and why they didn’t match Loqbox’s real credit-building timeline, so we could better support customers and improve their long-term outcomes.

DISCOVERY

Why were customers cancelling?

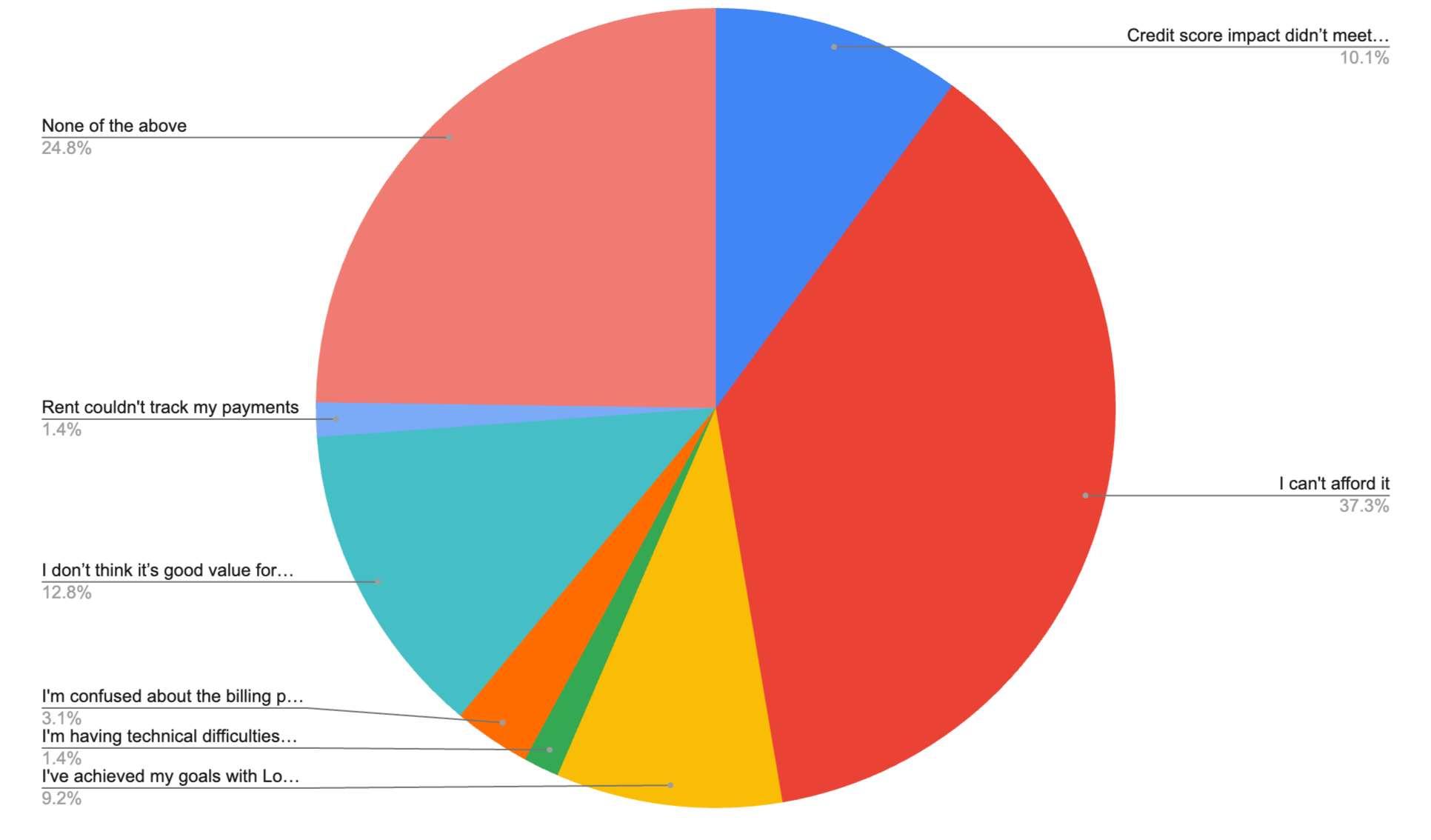

I analysed the exit survey data to explore reasons for cancelling what I found:

- The main reason after affordability was credit score didn’t meet my expectations.

- Looking at the sub-reasons, many customers felt their score had “no improvement” or a “negative impact”.

NPS feedback reinforced this

Detractors often mentioned:

- No visible score improvement.

- Not understanding when to expect results.

- Feeling unsure whether Loqbox was working for them.

Exit survey response data

Why weren’t customers achieving a credit score increase?

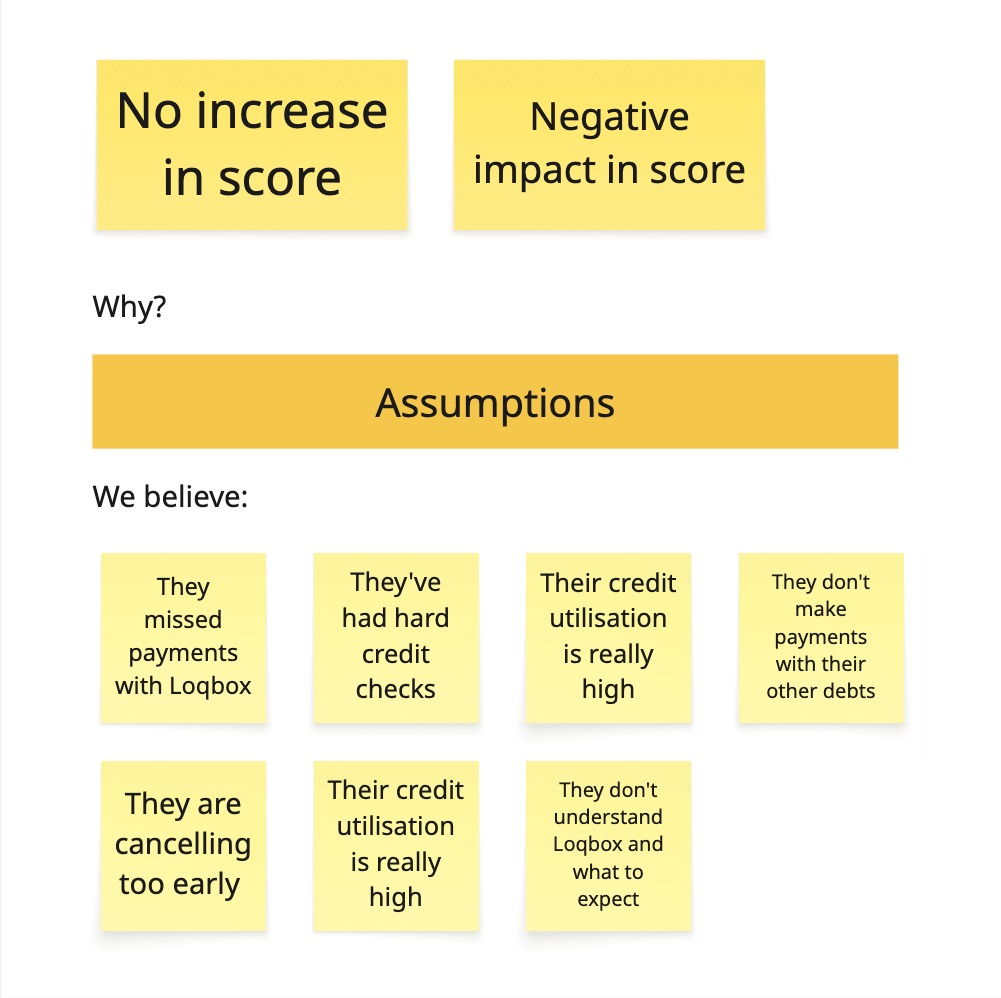

Why weren’t customers achieving a credit score increase?I listed out my assumptions:

- They might not understand how credit building works.

- They may have other credit behaviours (e.g., high utilisation, missed payments) impacting their results.

- Users may be cancelling too early, before Loqbox has had time to affect their score.

Research constraintsDue to research constraints (no budget for interviews, difficulty sourcing participants, limited analyst time), I analysed sign up to cancellation timing.

Assumptions on why customers saw no increase in their score

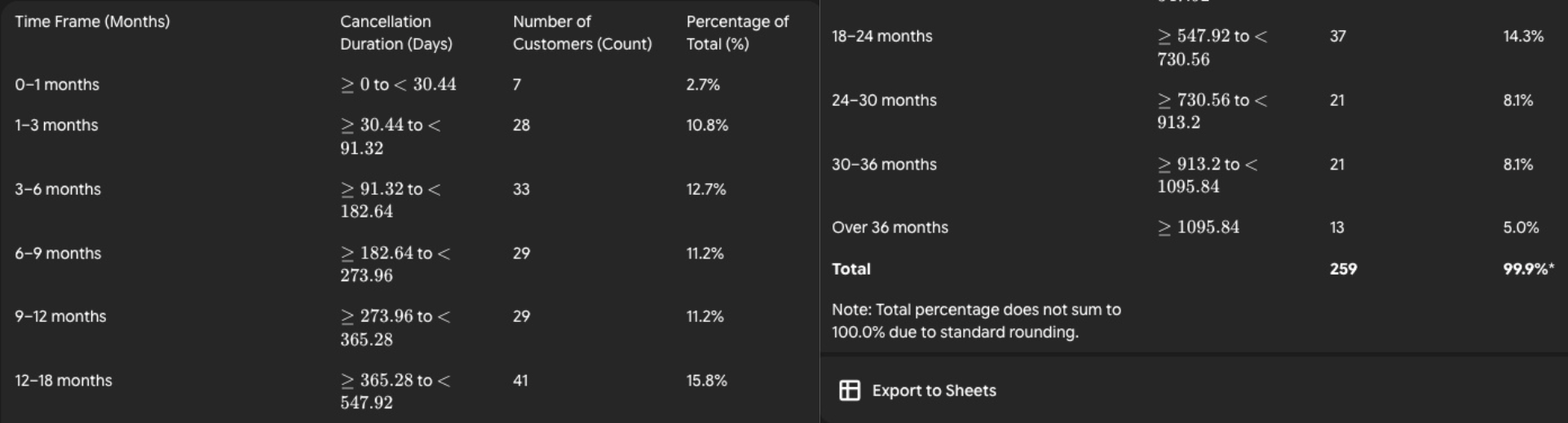

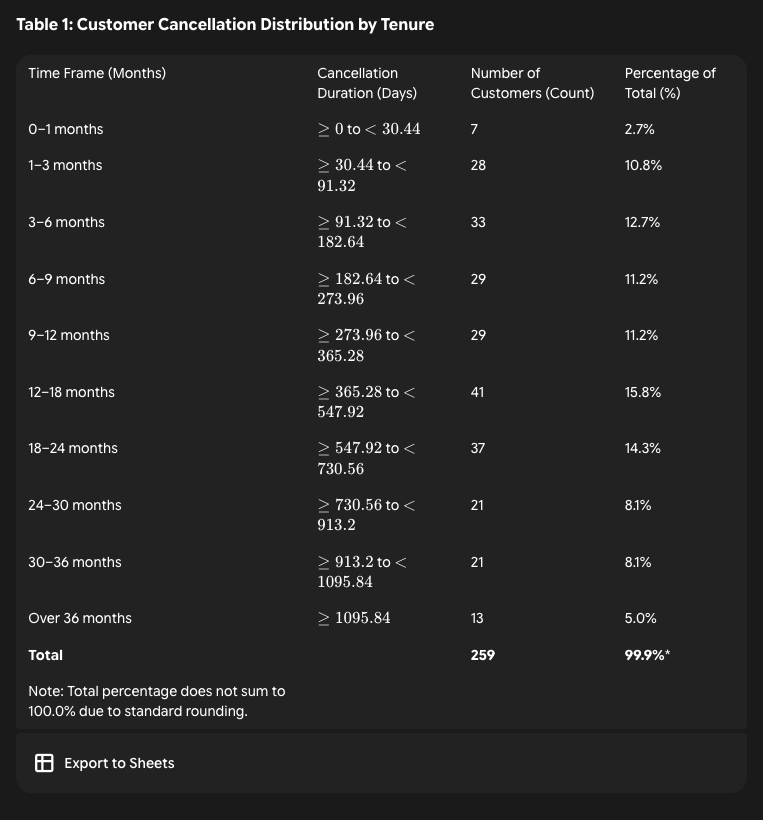

Were customers cancelling too early?

Given the constraints, I started looking at sign up date to cancellation date data in days and I found:

I found a clear pattern:

- Many customers cancelled between 0–3 months

- Loqbox typically starts influencing scores around 3–4 months

This revealed a key insight:

The issue wasn’t product performance. It was misaligned expectations and a lack of confidence during the early part of the journey.

Data showing customers time in days from sign up to cancellation

EXPLORATION

Initial Solution Exploration

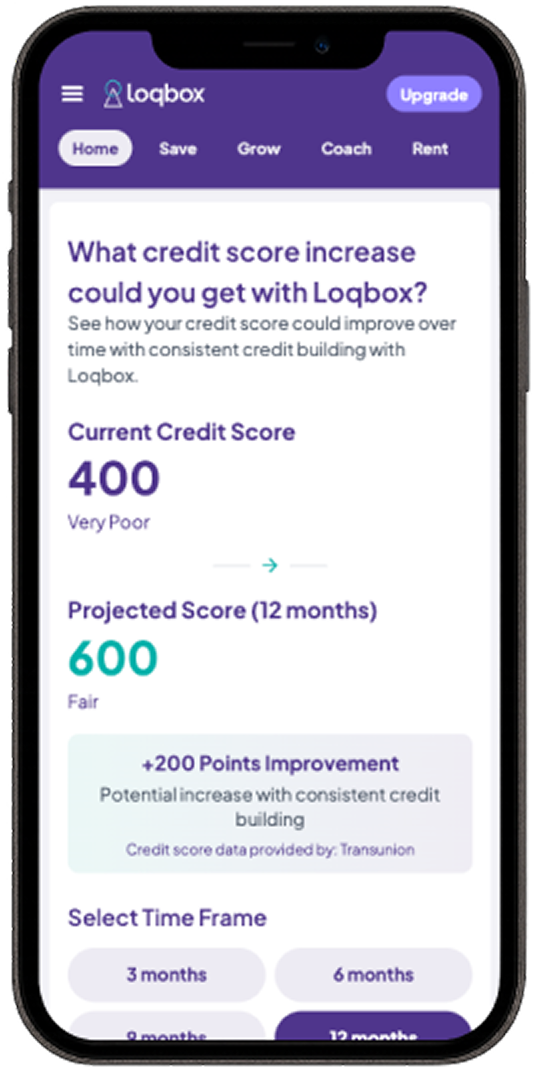

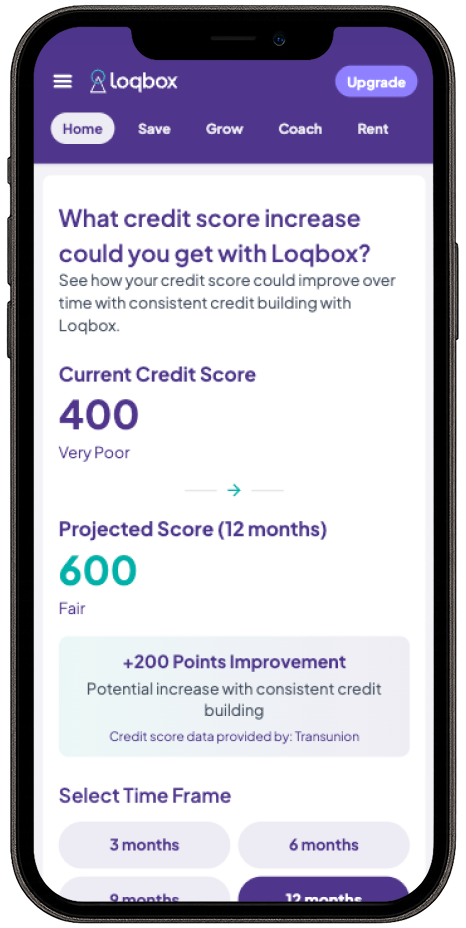

Hypothesis:If we show members who cancel early the credit improvement they could expect after 12 months, then they’ll be more likely to stay because they understand the longer-term value.

Testing

I ran an unmoderated test with 5 participants, with a success measure of 4 out of 5 saying the forecast would encourage them to continue.

Results

- 3 out of 5 said the page would convince them to stay

- Participants wanted more personalisation

- They wanted richer more in-depth Trustpilot reviews

- They questioned how the improvement translated into real-world benefits

Realisation

The forecast was useful, but showing it at the point of cancellation was too late. Participants needed confidence much earlier in the journey.

Credit score projection screen in the cancellation flow

Pivoting the Direction

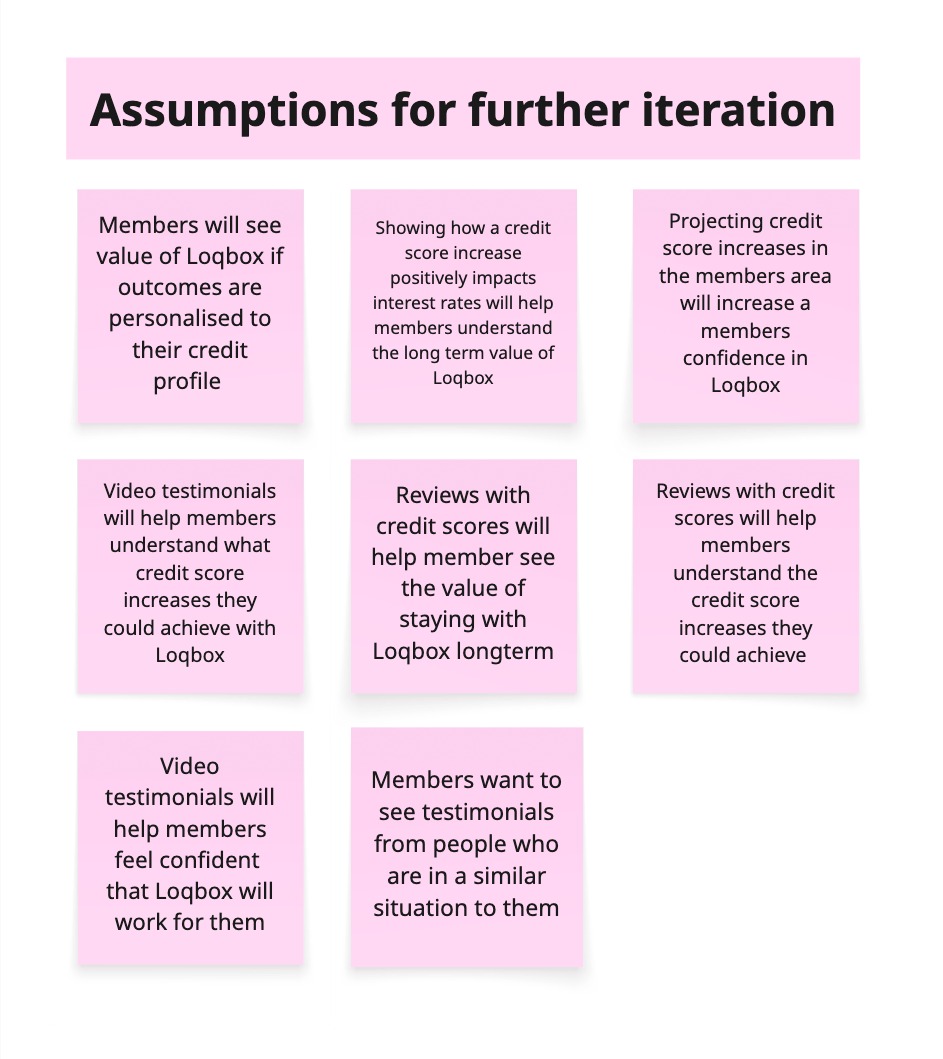

Based on insights from testing, I reframed the challenge from “retaining customers at cancellation” to “building confidence before doubt sets in.”

I listed new assumptions:

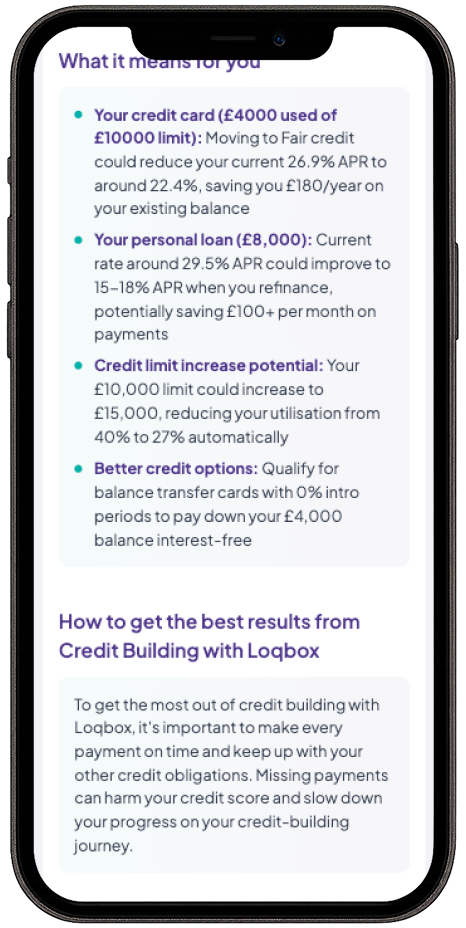

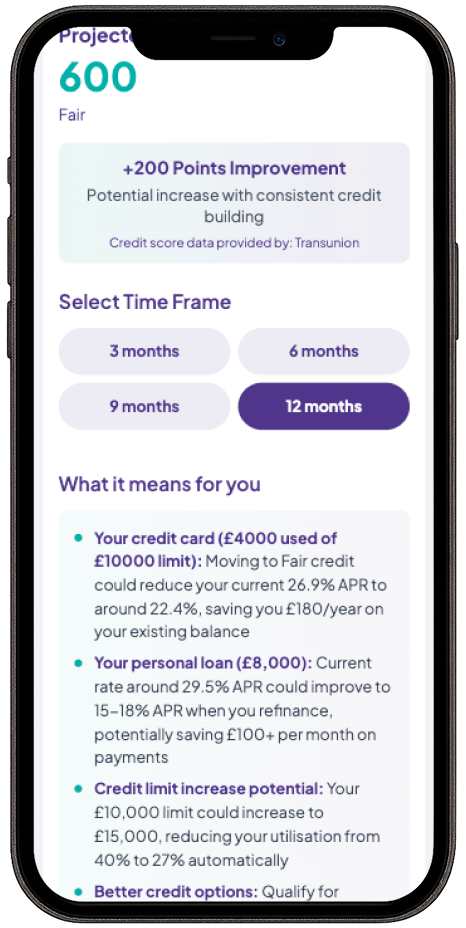

- Members will see more value if outcomes are personalised to their credit profile.

- Showing how credit improvements translate to real-world benefits (e.g., lower interest rates) increases perceived value.

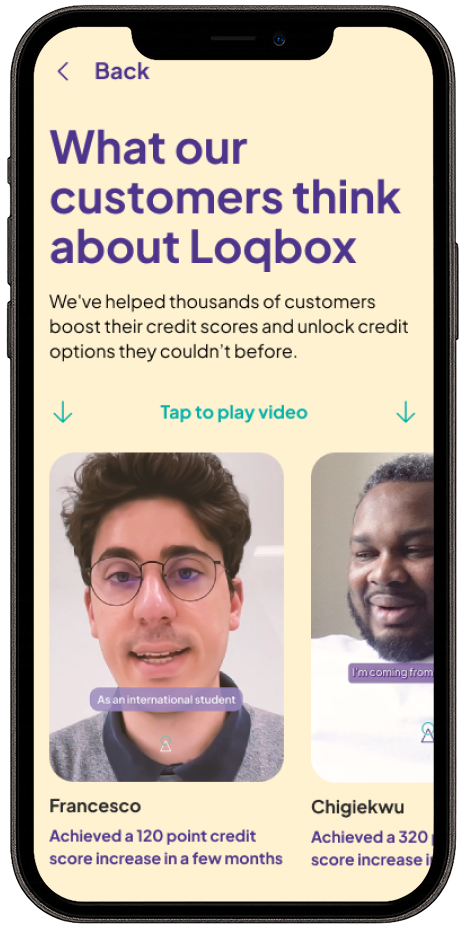

- Reviews with score improvements or video testimonials from similar users would build trust.

I converted these into hypotheses to test in usability studies:

- Showing a personalised credit trajectory could build confidence.

- Helping members understand how credit improvements affect their credit file could increase perceived value.

- Video or written testimonials from people in similar situations may increase trust and reduce early cancellations.

List of new assumptions

SOLUTIONS

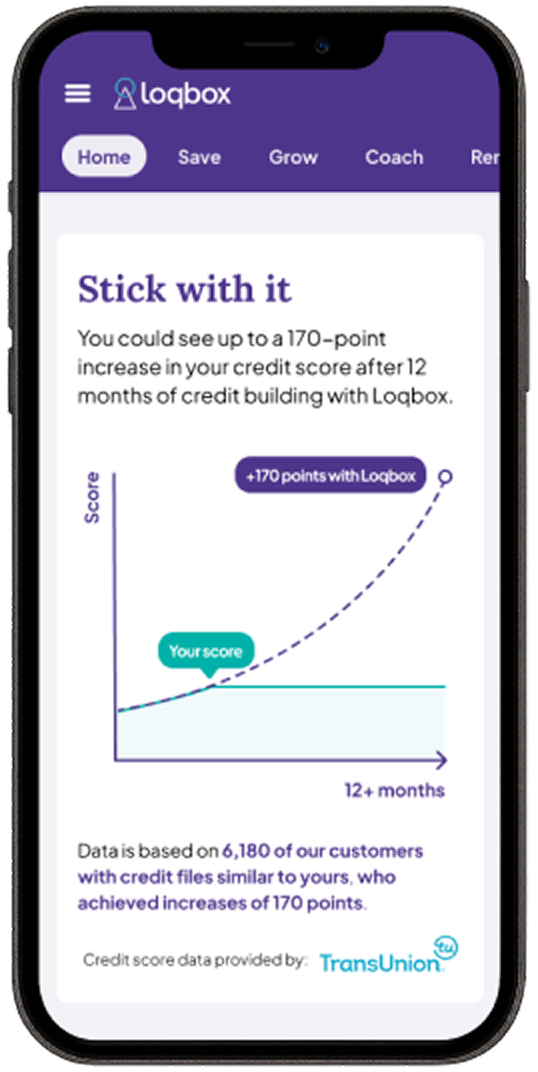

Credit Forecasting

A concept that gives members a clearer sense of how their score could progress over time. It aimed to:

- Make timeframes more concrete.

- Show how steady behaviour compounds.

- Set realistic expectations upfront.

- Reduce early “nothing is happening” cancellations.

Test resultsResults strongly validated my hypotheses.Average confidence score: 7.8 / 10

Average usefulness score: 8.1 / 10

Testers described the feature as:“motivating” and “helpful for understanding how credit works.”

"I like the fact it actually tells you the value of

improving your credit score... you can see that you can generally save"

View prototype

Credit forecasting for the logged in experience

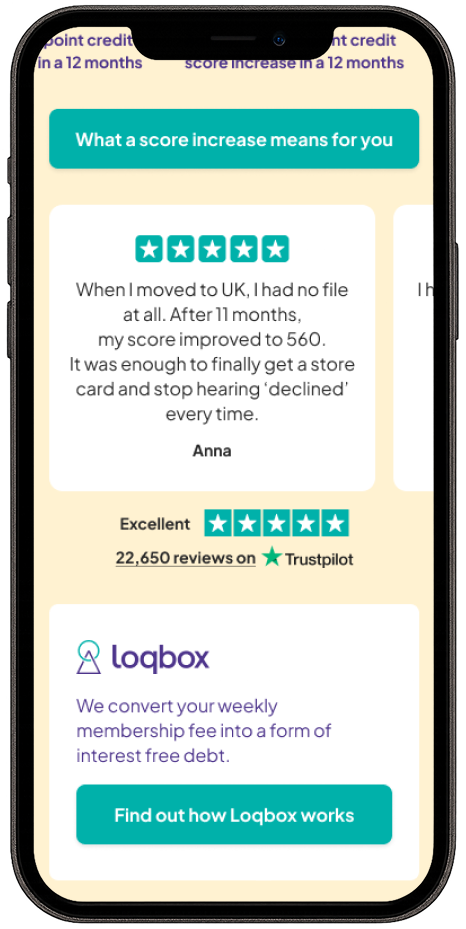

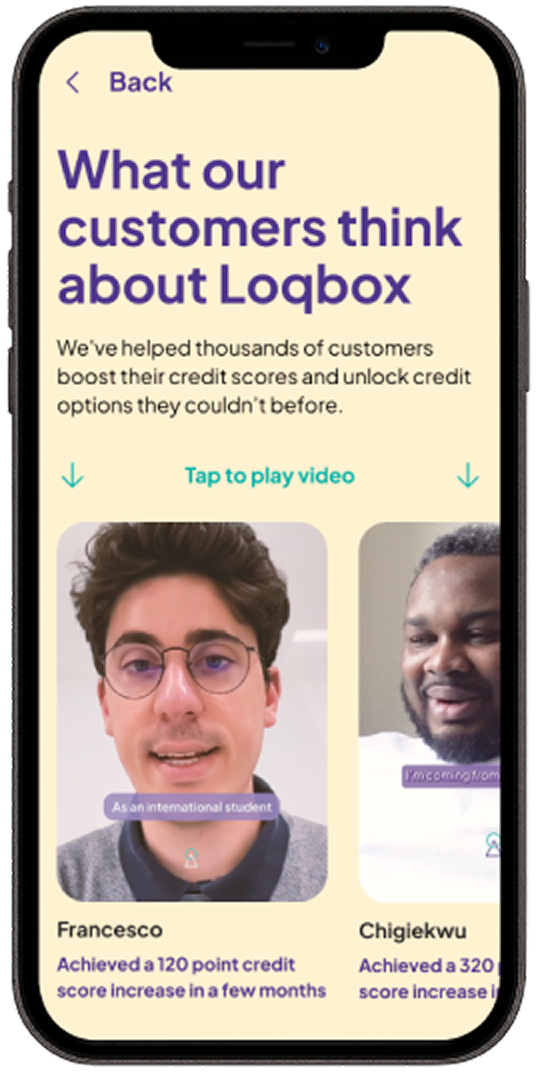

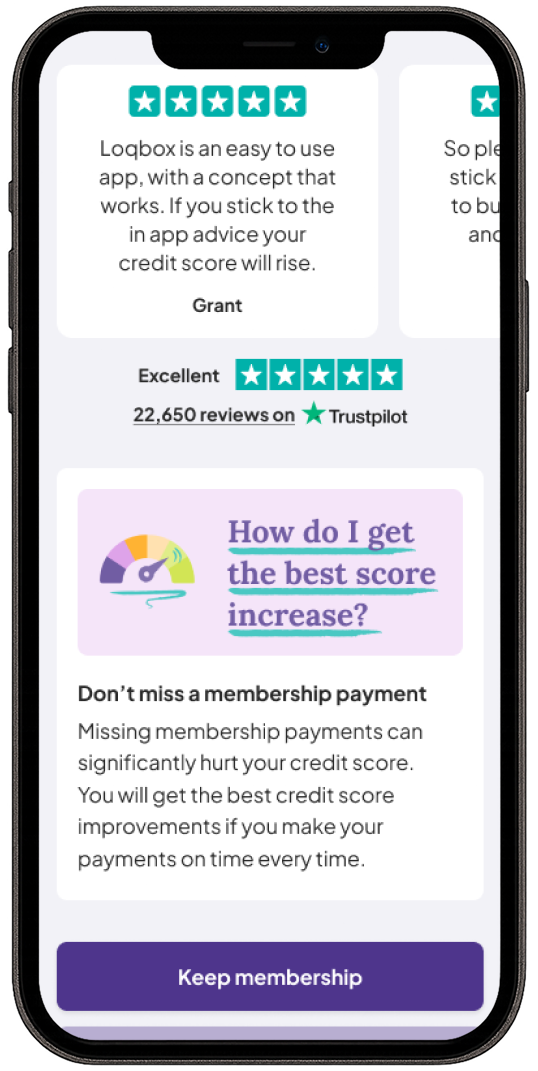

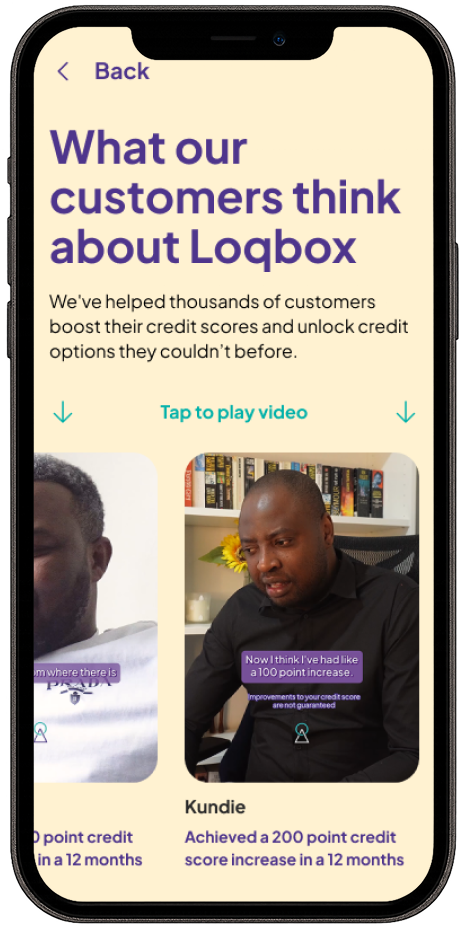

Personalised Testimonials

Stories from people with similar circumstances that explained:

- How they used Loqbox.

- When they started seeing results.

- What their journey felt like.

Designed to make success relatable and help set expectations.

Test resultsResults strongly validated my hypotheses.Average confidence score: 7.6 / 10

Average usefulness score: 8.4 / 10Testers reported that personalised stories made them feel like: “it could work for me.”

View prototype

Personalised reviews and video testimonials

Outcomes achieved:

These concepts did not go straight into production, but they:

- Clarified the root causes of early cancellations and highlighted confidence as a key driver.

- Identified effective ways to set clearer expectations earlier in the journey.

- Produced validated concept directions ready for further testing and potential A/B experimentation.

- Informed future retention strategy and how Loqbox supports customers through the early months of their credit building.

Reflections and learnings

Building confidence early is essential in long-term behaviour-change products. People need relatable proof and clear expectations before they see results. Designing for the “invisible” part of the journey is just as important as designing for the visible one.

Next steps

The positive results meant that other teams would be exploring how feasible it would be to implement the solutions. While this was happening I would start testing the concepts with Loqbox customers.